External Audit Service In UAE

External Audit Services in UAE

Why External Audit Services Matter in the UAE

In the dynamic business environment of the UAE, regulatory compliance, financial transparency, and trust are non-negotiable. Whether you’re operating a mainland company in Dubai or a Free Zone entity in Abu Dhabi, undergoing a statutory audit is not just a regulatory requirement—it’s a strategic necessity.

As per the UAE Commercial Companies Law (Federal Law No. 32 of 2021), every company is required to appoint licensed external auditors and submit audited financial statements annually. The Federal Tax Authority (FTA) also mandates audited financials for VAT compliance, ESR (Economic Substance Regulations), and Corporate Tax assessments.

AEY Auditing – Trusted External Auditors in Dubai, UAE

With decades of local experience, AEY Auditing of Accounts stands as a leading provider of external audit services in Dubai and across the UAE. Our team comprises qualified auditors registered in Dubai, all compliant with ISA (International Standards on Auditing) and IFRS (International Financial Reporting Standards).

We work with a diverse portfolio of UAE businesses—from SMEs to large corporations, multinationals, family-owned businesses, and Free Zone companies

AEY Auditing – Approved External Auditors in Major UAE Free Zones

AEY Auditing is a registered and approved auditor in numerous Free Zones across the UAE, including top jurisdictions such as DMCC, IFZA, SPC, and RAKEZ. Our long-standing reputation and consistent compliance with Free Zone Authority guidelines make us a trusted name for external audit services in Dubai and UAE.

Here’s a detailed breakdown of our services across 20 Free Zones:

Free Zone | Location | AEY Auditing Services Provided |

DMCC – Dubai Multi Commodities Centre | Dubai | Statutory audits for license renewal, FTA & VAT audit support, ESR assessments |

IFZA – International Free Zone Authority | Dubai (Silicon Oasis) | Year-end audit reports, financial reviews, business setup compliance |

SPC – Sharjah Publishing City | Sharjah | Annual audit, financial statement preparation, internal control checks |

DIFC – Dubai International Financial Centre | Dubai | Regulatory reporting, compliance with DFSA rules, full IFRS audit |

DAFZA – Dubai Airport Free Zone | Dubai | FTA-compliant audits, tax return assistance, management letters |

JAFZA – Jebel Ali Free Zone | Dubai | Audit certification for renewal, cost center analysis, financial integrity checks |

RAKEZ – Ras Al Khaimah Economic Zone | Ras Al Khaimah | Audit reports, bookkeeping review, ESR, and VAT compliance support |

SHAMS – Sharjah Media City | Sharjah | Creative industry audits, Free Zone compliance, corporate tax readiness |

Meydan Free Zone | Dubai | Fast-track audit submission, license extension support, bank financing readiness |

Ajman Free Zone (AFZ) | Ajman | External audits, VAT audit, FTA documentation reviews |

Hamriyah Free Zone | Sharjah | Inventory audits, financial audits, and internal control enhancement |

Dubai South | Dubai | Statutory audit services, project-based financial reviews |

Khalifa Industrial Zone (KIZAD) | Abu Dhabi | Compliance audits, KPI-based reporting, risk assessment |

Dubai Silicon Oasis (DSO) | Dubai | Tech-sector focused audits, tax and financial due diligence |

Masdar City Free Zone | Abu Dhabi | Green sector audits, financial and ESG reporting |

Creative City Fujairah | Fujairah | Financial reviews for media startups, audit trails for investors |

Dubai Design District (d3) | Dubai | Design-focused financial audits, FTA compliance, and corporate tax prep |

Umm Al Quwain FTZ (UAQFTZ) | UAQ | SME-friendly audit packages, regulatory and FTA compliance |

Abu Dhabi Global Market (ADGM) | Abu Dhabi | High-net-worth individual and corporate group audits |

Fujairah Free Zone (FFZ) | Fujairah | End-of-year financial audits, internal audit consulting |

Note: All AEY audit services in these zones comply with UAE Commercial Companies Law, FTA regulations, and International Standards on Auditing (ISA).

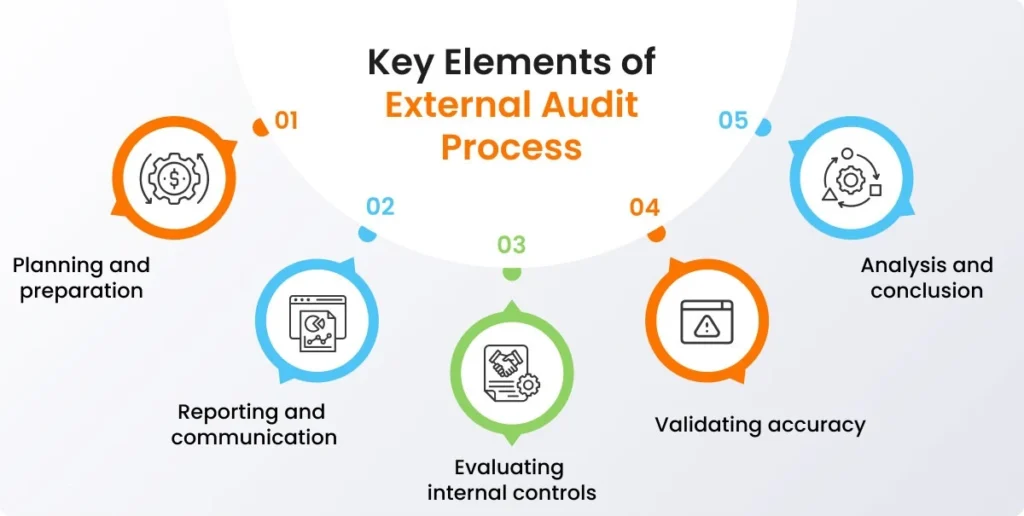

Our External Audit Process (Statutory Audit Steps)

We follow a structured, professional approach for every external audit in Dubai:

Initial Consultation & Risk Assessment

Understand your business and industry

Identify areas of financial risk

Discuss scope and timeline

Planning & Strategy

Set clear audit objectives

Allocate a dedicated audit team

Develop a tailored audit plan

Execution of Audit Fieldwork

Inspect accounting records and internal controls

Verify transactions, balances, and procedures

Evaluate financial statement accuracy

Compliance Checks

Review compliance with UAE Commercial Companies Law

Cross-check FTA VAT filings and ESR documentation

Validate adherence to IFRS and ISA standards

Reporting & Recommendations

Issue independent audit report with auditor’s opinion

Provide a Management Letter with improvement suggestions

Offer post-audit consulting for risk mitigation and compliance strengthening

Get A Free Quotes

Key Benefits of External Audit Services in UAE

Choosing AEY Auditing means gaining access to:

- FTA and UAE Commercial Companies Law compliance

- Credible, independent financial assessment

- Strengthened stakeholder trust

- Readiness for bank financing and investor due diligence

- Avoidance of regulatory fines and penalties

- Clear financial insights for informed decision-making

Industries We Serve Across the UAE

Hospitality & Tourism

Logistics & Supply Chain

Construction & Real Estate

Oil & Gas

Healthcare & Pharmaceuticals

Tech Startups & E-commerce

Manufacturing & Trading

Professional Services

Why Choose AEY Auditing as Your External Auditors in UAE?

Feature | AEY Auditing Advantage |

Experience | 15+ years serving UAE businesses |

Expertise | Fully qualified, Dubai-registered auditors |

Standards | ISA and IFRS compliance |

Reputation | Trusted by major Free Zones and UAE-based banks |

Technology | Use of audit software for accuracy and speed |

Support | Post-audit consultancy and continuous compliance advisory |

How We Ensure Compliance with UAE Laws

Transparent Pricing for External Audit in Dubai

We offer competitive, transparent pricing tailored to your business size and complexity.

Business Type | Starting Audit Fee (AED) | Delivery Timeline |

Small Businesses | AED 3,500 | 7–10 Working Days |

Medium Enterprises | AED 7,500 | 10–15 Working Days |

Large Corporations | Custom Quote | Based on Scope |

Note: All fees include full financial audit, FTA-compliant reporting, and statutory filing support.

Free Zones

We are approved auditors by the following UAE free zones

Get Started with us today

Your business is special. Let us calculate your dreams

FAQs on External Audit in UAE

Is a statutory audit mandatory for my company in UAE?

Yes, as per the UAE Commercial Companies Law, all mainland companies must undergo an annual audit. Most Free Zones also require statutory audits.

What is the external audit process like in Dubai?

It involves planning, fieldwork, financial review, compliance checks, and reporting—all done in line with IFRS and ISA standards.

How long does an external audit take in the UAE?

Depending on the company size, audits usually take 7 to 20 working days. AEY Auditing ensures timely delivery without compromising quality