Anti-Money Laundering (AML)

Anti-Money Laundering (AML)

The UAE Federal Law on AML and Combating Terrorism Financing (CTF) is applicable to: The accountants and auditors, precious metal dealers, real estate dealers, and corporate service providers must apply Law No. 20 of 2018 related to AML in the UAE.

Our Consulting Services for UAE Anti-Money Laundering Law

1. Record of AML/CFT Policy, Controls, and Procedures

We develop flexible and customized AML/CFT compliance frameworks in line with your business requirements. These include strong policies, procedures, and best practices to ensure smooth compliance with UAE AML laws.

2. In-House AML Compliance Department Setup

Our consulting services ensure that the AML compliance departments can cover the dynamic challenges of AML/CFT and stay resilient to the threat of money laundering in your organization.

3. AML Training

We offer extensive training in prominent AML subjects such as UAE laws, KYC, screening, risk profiling, CDD, EDD, and STR filing so that your team shall remain compliant and proactive.

4. AML Software Selection

We help businesses choose low-cost AML software that supports transaction monitoring, customer screening, and compliance with all regulations while streamlining activities and minimizing risks.

5. Annual AML/CFT Risk Assessment Report

We help DNFBPs and Financial Institutions prepare and file the annual AML/CFT Risk Assessment Report as required by the UAE Ministry of Economy.

6. AML/CFT Health Check

This service assesses your organization’s adherence to the AML/CFT guidelines and determines which areas are lacking and need urgent improvements..

7. Business Risk Assessment

We perform comprehensive AML Business Risk Assessments (BRA) to help DNFBPs and Financial Institutions identify and address financial crime vulnerabilities effectively..

8. Regulatory Reporting

We support businesses in meeting UAE’s regulatory reporting requirements, ensuring compliance with government mandates for transparency and accountability.

9. Managed KYC and Customer Due Diligence Services

Our managed services provide cost-effective solutions for KYC and CDD, ensuring alignment with AML regulations while optimizing your compliance costs.

Introduction to AML in the UAE

The financial hub and trading centre that makes UAE particularly vulnerable to money laundering and terrorist financing needs effective measures that combat it. The country has had a strong establishment of anti-money laundering and counter-terrorist financing framework.

The financial hub and trading centre that makes UAE particularly vulnerable to money laundering and terrorist financing needs effective measures that combat it. The country has had a strong establishment of anti-money laundering and counter-terrorist financing framework.

Why AML Matters

- AML practices safeguard financial institutions against exploitation for criminal activities. Delinquency in adherence to such regulations may result in significant financial, reputational, and legal consequences. Major AML Institutions in the UAE UAE Central Bank- It checks compliance within the banks and financial markets.

- Dubai Financial Services Authority (DFSA): Dubai International Financial Centre (DIFC)

Executive Office for AML/CFT- Aligns Countrywide Anti-money laundering efforts

Understanding Money Laundering

- What is Money Laundering?

Money laundering is the process of disguising illegal proceeds so that they seem legitimate. The final objective is to introduce illicit money into the legitimate economy without detection..

- Stages of Money Laundering

Placement: Introduction of illegal funds into the financial system

Layering: Changeling funds through complicated financial transactions to disguise their source

Integration: Introduction of laundered funds into the legitimate economy through investments or big purchases

- Impact of Money Laundering

Undermines financial institutions.

Facilitates criminal activities.

Damages the economy and public trust.

Get A Free Quotes

Regulations and Guidelines in the UAE

The UAE has implemented comprehensive laws to combat money laundering, aligned with FATF (Financial Action Task Force) recommendations.

Federal Decree-Law (No. 20 of 2018)

This landmark law establishes the UAE’s legal framework to combat money laundering and terrorist financing. It criminalizes:

- Money Laundering Activities

Including the transfer, concealment, or possession of illicit funds.

- Non-compliance Negligence

Businesses that do not institute adequate AML measures.

Cabinet Decision (No. 10 of 2019)

This decree entails clear executive regulations aimed to aid the implementation of Federal Decree-Law No. 20. The decision contains the operational requirements that businesses are required to observe, which include:

- Risk-Based:

- Approach: Firms have to identify and mitigate risks in respect of customers, transactions, and services

- Customer Due Diligence (CDD): Subjects high-risk customers and transactions to rigid scrutiny.

- Suspicious Transaction Reports (STRs): Requires that suspicious activities be reported promptly to UAE’s Financial Intelligence Unit (FIU).

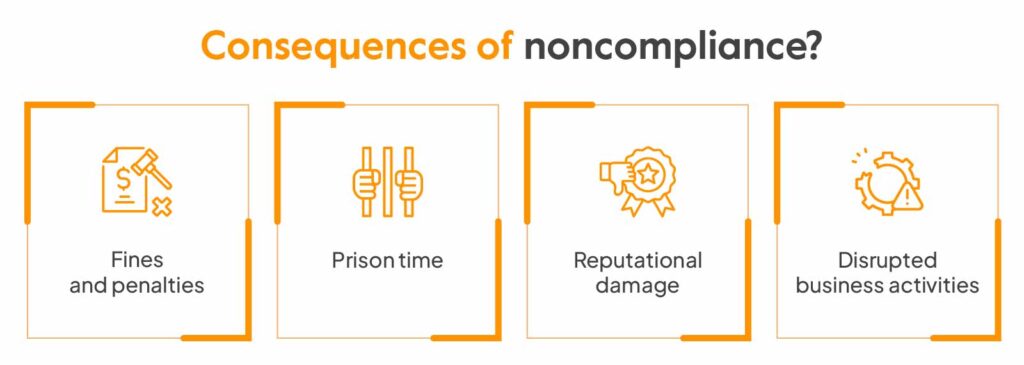

Penalties for ( Non-Compliance)

Non-compliance with AML laws carries severe consequences:

- Fines: Up to AED 50 million, depending on the nature and severity of the offense.

- Business Suspension: Temporary or permanent shutdown of operations.

- Criminal Prosecution: Imprisonment for individuals involved in deliberate violations.

- Role of FATF (Financial Action Task Force)

The UAE collaborates with FATF to identify and mitigate AML risks. By following FATF recommendations, the UAE:

- Strengthened its financial regulatory framework.

- Enhanced transparency in financial reporting and due diligence.

- Improved global trust in its financial systems through targeted reforms.

Recent Developments:

The FATF acknowledges the UAE’s ongoing efforts to implement measures like enhanced penalties, cross-border monitoring, and technological advancements in AML

Key AML Penalties

Violation | Fine (AED) | Additional Actions |

Failure to report SAR | Up to 1 million | Business suspension |

Inadequate CDD measures | Up to 5 million | License revocation |

AML Training Courses in Dubai

Training is essential for ensuring staff understand AML laws and regulations. Key courses include:

- CAMS Certification: A globally recognized AML credential.

- ICA Diploma in AML: Comprehensive training for compliance officers.

Top 10 AML Software for Banks in Dubai

| Software | Key Feature | Pricing |

| LexisNexis Risk Solutions | Transaction monitoring | $12,000/year |

| FICO TONBELLER | AI-driven detection | $15,000/year |

| Oracle Financial Services | Risk-based analytics | Custom Pricing |

Get Started with us today

Your business is special. Let us calculate your dreams

FAQs Of AML UAE

What is Customer Due Diligence (CDD)?

CDD is verifying customer identities to assess their risk level before initiating financial transactions.

What is Enhanced Due Diligence (EDD)?

EDD involves additional scrutiny for high-risk customers or transactions to prevent money laundering.

What is a Suspicious Transaction Report (STR)?

An STR is filed when unusual transactions suggest potential money laundering.

What is an AML Business Risk Assessment (BRA)?

A BRA evaluates a business’s exposure to financial crime risks and outlines mitigation strategies.

Why is audit important in UAE?

If you are an entrepreneur in Dubai, it is essential to get an audit. It’s significant because it assures that your company records are reliable and in order. Auditors in Dubai, while conducting audits, examine internal controls of a company. All of the sudden, they also inspect the existing system, coupled with the financial statement.

What are the penalties for AML non-compliance in the UAE?

Fines can reach AED 50 million, along with potential business suspension or criminal prosecution.