Agreed Upon Procedures (AUP)

Agreed Upon Procedures (AUP) Services in Dubai,UAE

In an increasingly complex financial landscape, businesses across Dubai and the UAE benefit from specialized assurance beyond standard audits. Agreed Upon Procedures (AUP) engagements offer tailored, scoped reviews designed to address specific concerns—from FTA compliance to investor due‑diligence checks. At AEY Auditing, we deliver precise AUP services in Dubai, offering focused audit procedures that empower informed decision‑making.

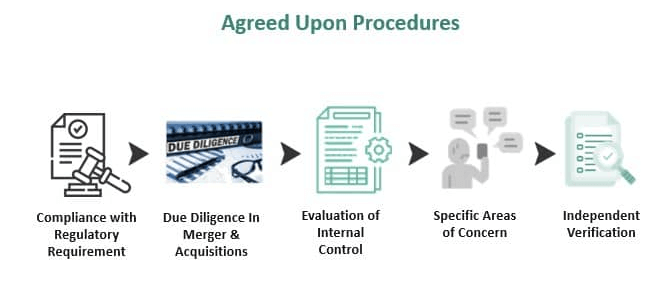

What Are Agreed Upon Procedures (AUP)?

Agreed Upon Procedures (AUP) are engagements under the International Standards on Related Services (ISRS 4400). In an AUP engagement:

You, our client, fully define the scope of the work.

We perform specific tasks, such as verifying transactions or testing compliance.

We don’t give an audit opinion; instead, AEY provides a report of our factual findings.

The results are used by recipients to draw their own conclusions based on the facts we’ve provided.

Why UAE Businesses Choose AUP

Dubai firms, Free Zones, and UAE regulators prefer AUP when:

Verification is required for a chunk of data, e.g., FTA VAT compliance checks

Investment or M&A deals need transaction testing on revenue pipelines

Grant or government application mandates proof of specific control procedures

Lease or contract dependencies require proof of performance (e.g., delivery or services)

Regulatory reporting in Free Zones like DIFC, ADGM, and DMCC demands factual confirmations

With tailored AUP service in Dubai, companies avoid costly audits while getting focused, credible results.

Our AUP Services in Dubai & UAE

AEY Auditing provides high‑quality AUP engagements with meticulous planning and execution. Our UAE‑focused process includes:

1. Engagement Planning & ScopingDiscuss objectives with stakeholders (board, investors, banks, regulators)

Define specific procedures (e.g., confirm bank balances, test five supplier invoices)

Agree on timeframe, sampling, reporting format, and security protocols

Ensure compliance with UAE Commercial Companies Law and FTA regulations

2. Execution of Agreed ProceduresWe perform only what was agreed. Common procedures include:

Verifying bank statement balances

Extracting and testing VAT transaction samples

Confirming receivables and payables

Checking payroll data accuracy

Inspecting lease agreements or loan covenants

Reviewing vendor invoices against delivery receipts

All work is performed under ISA‑based methodologies and documented rigorously.

3. Reporting of FindingsDeliverable includes:

A factual report listing procedures performed

Observed results without conclusions or opinions

Potential recommendations (if requested)

A clear statement that no audit opinion is being issued

4. Debrief & Follow‑UpReview findings with stakeholders

Optional: Perform additional AUP scope if required

Plan for documentation and further regulatory compliance

Get A Free Quotes

Benefits of AUP Services in Dubai,UAE

Adopting Agreed Upon Procedures brings distinct advantages:

Benefit | Description |

Laser‑Focused Assurance | Only the procedures that matter—for compliance, financing, or due diligence |

Cost & Time Efficient | Faster and cheaper than full audits |

Regulatory & FTA Ready | Aligns with UAE Commercial Companies Law, FTA directives, and Free Zone rules |

Customizable & Scalable | Scope can be expanded or narrowed per business need |

Credible & Reliable | Factual findings, no ambiguous opinions |

Great for Reporting Needs | Ideal for license renewals, project completion, and government grants |

Common AUP Use Cases in UAE

FTA VAT Verification

Test transactions to ensure accurate VAT reporting

Support FTA audits with factual findings rather than guesswork

🔹 Investor & Buyer Due Diligence

Analyze financial metrics before funding or acquisition

Check customer contracts, debt liabilities, lease balances, inventory

🔹 Free Zone & Regulatory Compliance

Confirm compliance with DIFC, ADGM, DMCC, JAFZA, and others

Provide evidence for corporate governance or licensing

🔹 Grant or Subsidy Validation

Verify contract-management milestones for grant release

Test date-based deliverables and ownership of assets

🔹 Operational or Contractual Checks

Validate performance triggers, milestone payments, service conditions

Support legal disputes, arbitration, or litigation assistance

How AEY AUP Service Works – Step by Step

Initial Consultation

Meet client (in Dubai/UAE) to understand needs and context

Distinguish between AUP, internal audit services, and full statutory audit

Proposal & Engagement Letter

Define scope, deliverables, fees, timeline, distribution, confidentiality

Ensure awareness of FTA, UAEs law, and international framework

Data Collection & Sampling

Client provides documents (statements, invoices, contracts)

We perform selective testing and gather evidence

Findings Documentation

Prepare a “Factual Findings” report as per ISRS 4400

Include photos, data extracts, confirmations, and factual data

Review & Finalization

Conduct client walkthrough

Finalize document for internal or external distribution

Optional Follow-Up

Add new scope

Assist with regulator response

Why AEY Auditing Delivers Best-in-Class AUP

Dubai Registered Auditors

Licensed under UAE Commercial Companies Law

Deep UAE Market Insight

Experience across Financial Audit UAE, Internal Audits, and Forensics

Advanced Tools

Forensic data analytics and automation for accurate results

TradingISA & IFRS Alignment

All procedures meet international standards

FTA & Free Zone Expertise

Widespread awareness of DIFC, DMCC, ADGM, DED

Confidentiality Assured

NDA-based service delivery

Pricing for AUP Engagements

Tailored based on scope, sampling, and access:

Scope | Starting Fees (AED) | Expected Timeline |

Simple single procedure (e.g. bank balance check) | 2,500 AED | 2–3 business days |

Multi-procedure AUP (e.g. VAT + payroll) | 6,000 AED | 5–7 business days |

Complex AUP (M&A due diligence, contract review) | Custom quotation | 10–15 business days |

Free Zones

We are approved auditors by the following UAE free zones

Get Started with us today

Your business is special. Let us calculate your dreams

FAQs about Agreed Upon Procedures in UAE

What’s the difference between AUP and an audit?

A statutory audit verifies full financials and issues an opinion. AUP is scoped, procedure-specific, and delivers factual results—no opinion.

Is AUP recognized under UAE law?

Yes. Conducted per ISRS 4400, it’s widely accepted by FTA, Free Zones, investors, and regulators.

Who uses AUP in UAE?

Regulators (FTA, Free Zones)

Investors and lenders

Grant agencies

Large corporates managing contractual responsibilities

Can AUP address VAT compliance?

Absolutely. We can test a sample of transactions for correct VAT treatment before FTA submissions.

How does confidentiality work in AUP?

All engagements are NDA-backed. Distribution restricted per engagement letter.