Company Formation

Company Formation

There are seven emirates in the UAE with their businesses and free zones. These also attract foreign investors throughout the world. The Emirates delivers a platform for various company formation in Dubai to get started. After the start, they need to get a business license according to business development. Hence, it can begin getting a corporate bank account and other visa processes.

Offshore company formation in UAE is a legal business organization, where businesses can be done internationally, outside the UAE jurisdiction. It must not be confused with the free zone in UAE. UAE offshore companies can get properties and firms worldwide, including UAE.

A registered agent must set up an offshore company formation in Dubai, unlike any other business. A E Y Auditing is a registered agent in the UAE that facilitates you registering your offshore company in UAE.

The UAE is like many offshore companies, prominently in RAK ICC and JAFZA.

The setup process:

To set up the offshore company in UAE, you will need to:

Gather the required documents

First, the required documents will depend on integrating your business. Some of the compulsory require documents include below:

- ID of shareholder

- Passport and Visa of shareholder

- A filed application of the business integration

- Prove of financial status

- A Memorandum of Association

- An Articles of Association

Establish a business plan

Second, you will create a comprehensive business plan and the firm’s setup. It should include details below:

- Your complete budget

- Project finances

- Liquidity

- Development plans

Get A Free Quotes

Find a Corporate Service Provider

Thirdly, it makes the procedure much more accessible. Therefore, it coordinates the complete setup and might offer advice related to the legalities of incorporation. Moreover, CSP charges a fee; however, these are worthwhile expenditures for the services they offer. It will also deliver the legal requirement of a Registered office address of the business.

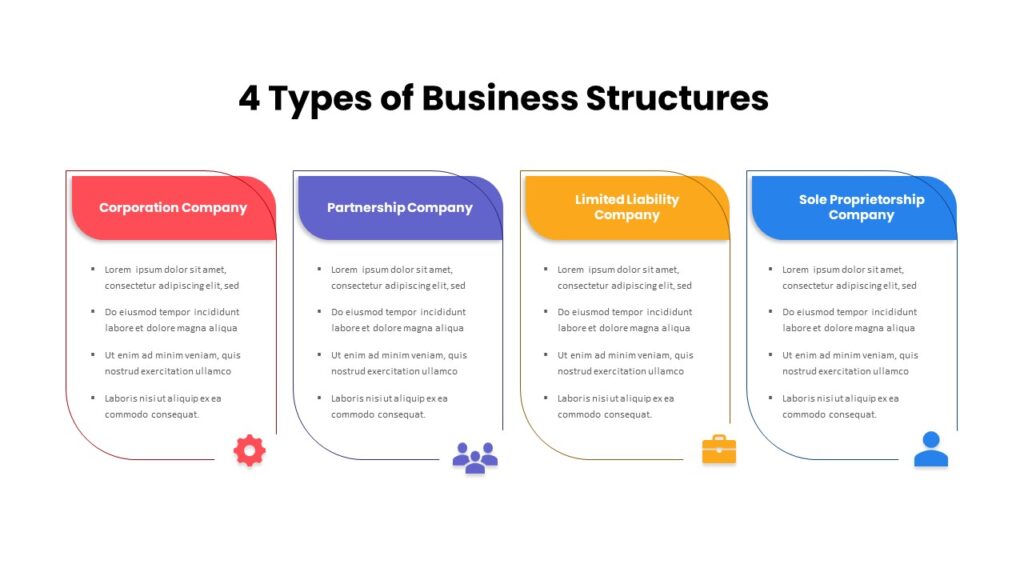

Choose a business structure.

Your company will need to be structured as below:

- A sole proprietorship

- A Limited Liability Partnership

- A PSC (Public Shareholding Company)

- A Private Shareholding Company

- A joint venture

Advantages of establishing an offshore company in the UAE

There are many benefits to setting up an offshore company in the UAE. I mention these as below:

- No existing corporate tax to pay

- 100% foreign ownership

- A speedy integration procedure

- Lawsuit protection-as it protects your possession if you are involved in any legal proceedings.

- Your assets are protected. The legal system of the UAE prevents creditors from grabbing assets of the offshore company.

- 100% privacy. As an offshore enterprise, you will get 100% privacy of your concerns.

- Choices to issue various classes of shares.

- It required a minimum of one shareholder and the director

Get Started with us today

Your business is special. Let us calculate your dreams

FAQs Of Auditing

Is Audit Required In UAE?

The general requirement of a business in the UAE is to maintain its records for not less than (5) years. The Commercial Company Law makes it mandatory for all companies in the mainland.

Who can perform an audit in the UAE?

According to UAE Commercial Company Law, every company needs to have auditors to audit their book of accounts. Under Federal Law no. 2 of 2015, Article 27, a licensed auditor is mandatory. Ministry of Economy in the UAE must approve it.

Who regulates auditors in the UAE?

Dubai Financial Services Authority registers well-known auditors. Therefore, it may appoint them to examine and report accounts of regulated DIFC entities.

Are auditors necessary?

However, if your company is usually free from an audit, you need an audit if your shareholders ask so. The shareholders must own at least 10% of the shares. Shares can be particularly on an individual or group level.

Why is audit important in UAE?

If you are an entrepreneur in Dubai, it is essential to get an audit. It’s significant because it assures that your company records are reliable and in order. Auditors in Dubai, while conducting audits, examine internal controls of a company. All of the sudden, they also inspect the existing system, coupled with the financial statement.

Is IFRS mandatory in Dubai?

Yes! IFRS standards are mandatory by the UAE Commercial Company Law No 2 of 2015. Listing rules of NASDAQ Dubai, Dubai Financial Market PJSC, Abu Dhabi Securities Exchange, and especially Dubai Financial Services also demand it.

How long does it take to become FCCA?

You can notably become an FCCA once you have a continuous membership of 5 years with ACCA. Further, you must meet CPD requirements of paying annual subscriptions every year.

How long does an audit take?

Once you file the return, the IRS usually starts these audits within a year. Within particularly six months, they lead to completion. However, expect a delay if you do not deliver the complete information. In fact, we also expected the delay if the auditor finds issues and wants to expand in other years or areas.

Required documents to prepare an audit of a company?

The mandatory documents by management are as below:

- Firstly, accounting reports with trial balance, balance sheet, ledgers, income statement, and relevant schedules

- Secondly, copies of vouchers, invoices, receipts, and bills

- Thirdly, a list of bank accounts used for transactions and forgeries of bank statements

- Moreover, maintained reports of all the payroll functions of a business.

- Further, copies of legal documents of the business

- Verifications from clients, suppliers, associated entities, etc.

- Above all, evaluate related parties and transaction examinations with related parties.

How can audit in Dubai assist your business to grow?

- Firstly, it helps accomplish business objectives. It will fix company weakness in all ways.

- Secondly, auditors in Dubai significantly facilitate identifying loopholes and risks in the financial report of your company.

- Thirdly, it boosts credit rating and valuation. You open doors for foreign investors and get the best financial position by calling an audit service.

- Moreover, it reveals the overall picture of your business. You can further focus more on your company’s strengths, weaknesses, opportunities, and threats once you have a clear vision.

Why should you choose A E Y Auditing to get your auditing services?

- Firstly, we follow our services’ highest professional ethics and quality level.

- Secondly, our company has a fast-growing team of qualified & dedicated professionals.

- Thirdly, you get new opinions to look at your business through Business Analysis, Creative Insight & Industry Benchmarking.

- We act as a Sounding board for crucial financial decisions and significantly provide dependable strategic leadership through our experience and knowledge.

- A E Y Auditing LLC is a UAE-registered auditing firm providing cost-effective value-added solutions to meet all your business needs.