Special Purpose Audit

Special Purpose Audit Services in Dubai,UAE

What is a Special Purpose Audit?

A Special Purpose Audit is a non-statutory audit conducted to address a specific stakeholder requirement. Unlike statutory financial audits, this audit is:

Conducted under a defined scope agreed with the client

Tailored for a particular event, regulation, or entity

Delivered in a custom format with exact findings, confirmations, and disclosures

We execute these audits in line with International Standards on Auditing (ISA 800/805) and ensure all reports are UAE-compliant and regulator-ready.

When Does Your Business Need a Special Purpose Audit in the UAE?

Scenario | Purpose of Audit |

FTA VAT Investigations | To verify the accuracy of VAT records before or after FTA assessments |

Free Zone License Renewals | Some Free Zones mandate specific reports outside general audits |

Investor/Partner Due Diligence | Validate contracts, capital contributions, receivables, assets |

Bank or Loan Requirements | Financial snapshot or collateral verification as per lender’s format |

Government Grant/Subsidy Audits | Confirm milestone delivery and fund usage |

Liquidation or Exit Audit | Audited closure accounts for compliance and distribution of assets |

Project-Based Financial Audits | Evaluate cost allocation and fund usage in large-scale projects |

M&A Transactions | Validate transaction-specific metrics, liabilities, or revenue streams |

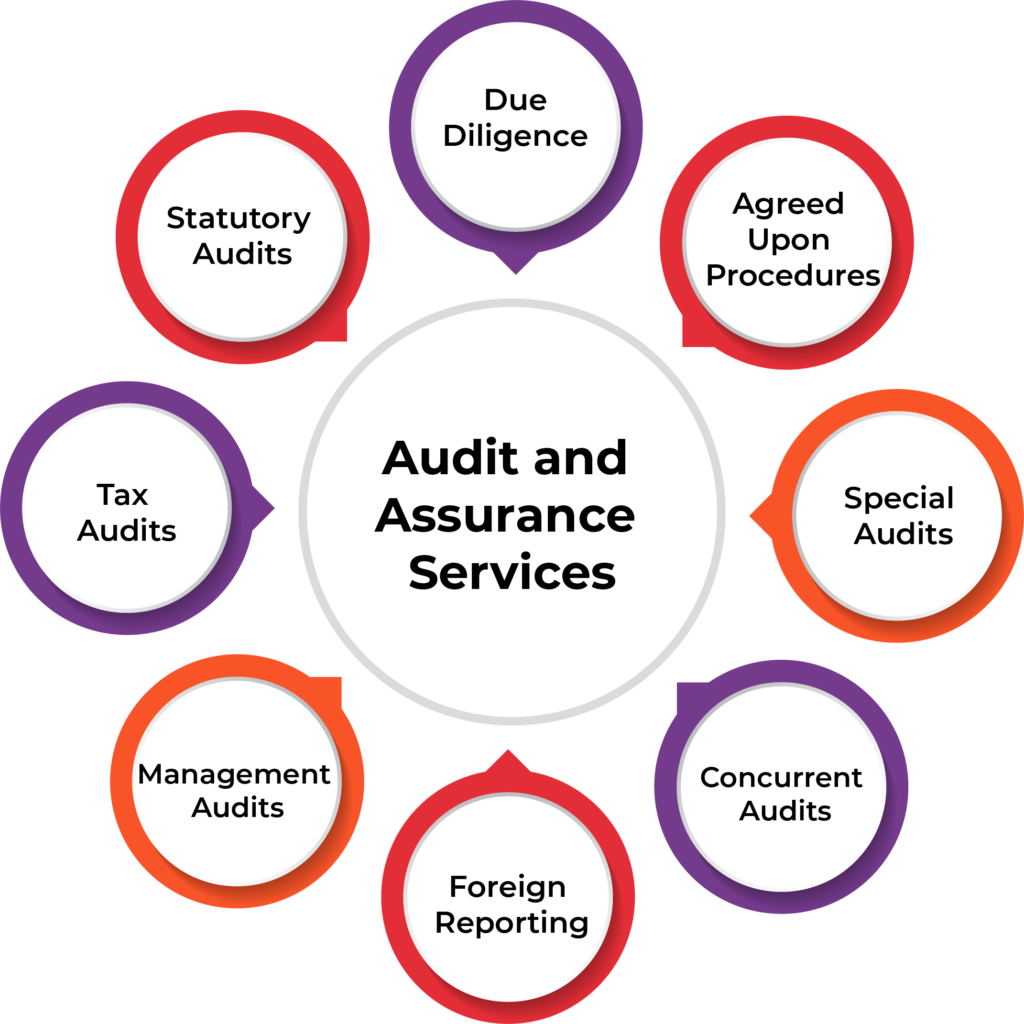

Types of Special Purpose Audit Services We Offer

AEY Auditing of Accounts offers diverse audit solutions tailored to your specific objective:

🔹 FTA VAT-Focused Audit

Examine VAT returns, invoice accuracy, and tax codes

Prepare for FTA audits or disputes

🔹 Free Zone Compliance Audit

DMCC, DAFZA, DIFC, RAKEZ, ADGM-ready reports

Confirm legal structure, shareholding, and compliance clauses

🔹 Capital Confirmation Reports

Verify capital injection, partner contributions, or escrow movement

Used in JAFZA, IFZA, or Abu Dhabi business setups

🔹 Financial Snapshot for Bank Loans

Provide interim financials as per banking covenants

May include inventory valuations, receivables aging, and net worth confirmation

🔹 Exit or Liquidation Audit

Audit for voluntary liquidation filings

Align with DED, MOE, and Free Zone liquidation processes

Our Special Purpose Audit Process

1. Understanding the Objective

Clarify what’s required: format, timelines, audience

Distinguish between financial audit vs. specific confirmation

2. Scoping & Planning

Determine data sources and stakeholders

Define methodology: sample testing, confirmations, reconciliations

3. Fieldwork & Testing

Conduct targeted audit procedures

Interview relevant departments

Review controls, documents, ledgers

4. Reporting

Deliver clean, clear, and factual audit reports

Incorporate auditor’s opinion or qualified confirmation as needed

5. Post-Audit Support

Support with submission to FTA, Free Zone authorities, or lenders

Provide ongoing consulting if further verification is required

Get A Free Quotes

Transparent Pricing for Special Purpose Audit Services

Audit Type | Starting Fee (AED) | Timeline |

FTA VAT Audit | 4,500 AED | 5–7 working days |

Capital Verification | 3,500 AED | 3–5 working days |

Liquidation Audit | 5,000 AED | 7–10 working days |

Bank Loan Snapshot | 4,000 AED | 3–6 working days |

Grant Verification | Custom | Scope-Based |

Note: Custom quotes available for complex or multi-entity audit engagements.

Industries We Serve

Healthcare & Pharmaceuticals

Construction & Real Estate

Tech & E-commerce

Retail & Distribution

Hospitality & Tourism

Education & Government Grants

Family-Owned Businesses & Groups

Why Choose AEY Auditing for Special Purpose Audit in Dubai?

Feature | AEY Advantage |

Licensed in Dubai & UAE | Registered with UAE regulatory authorities |

Industry Expertise | Experience across real estate, healthcare, trading, logistics, tech |

IFRS & ISA Standards | Reports issued in line with international audit standards |

FTA & Free Zone Familiarity | Understand local authority formats and documentation needs |

Fast Turnaround | Agile audits with detailed planning and streamlined delivery |

Custom Reporting | Formats aligned with bank, investor, or government templates |

Free Zones

We are approved auditors by the following UAE free zones

Get Started with us today

Your business is special. Let us calculate your dreams

FAQs on Special Purpose Audit in the UAE

Is a Special Purpose Audit the same as a statutory audit?

No. A statutory audit reviews full financials and issues an overall opinion. A special purpose audit is narrow in scope, often focused on a single issue or requirement.

Do Free Zones in UAE accept special purpose audit reports?

Yes, many Free Zones require or accept custom reports for compliance, license renewal, or capital verification.

Is a special purpose audit valid for FTA requirements?

Yes, when properly scoped, a special purpose audit can serve as supporting documentation for VAT or tax inspections.